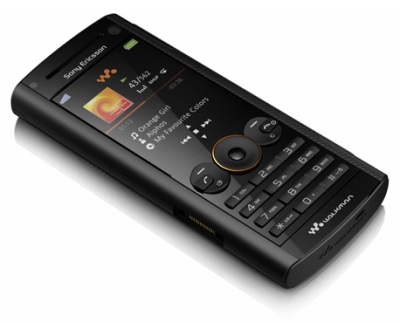

Sony Ericsson insurance

For many years now Sony Ericsson has been a popular make of high quality mobile phone handsets - all of which are well worth spending that little extra on to cover them with Sony Ericsson mobile phone insurance. Sony Ericsson continue to manufacture mobile phones to suit all budgets from basic Spiro models at around £30 to their top-end models like the Experia valued at up to £500. Regardless of the Sony Ericsson model that you own – can you afford not to take out Sony Ericsson mobile phone insurance?

Pay-As-You-Go Sony Ericsson mobile phone insurance

For low volume users, buying a pay-as-you-go Sony Ericsson phone outright and using a 'top-up' card to give you credit so that you can make calls, send texts and even use the internet - can make real sense. The best way to approach whether or not you would benefit from a pay-as-you-go phone is to take the price of the handset and add to that the amount of credit per month you expect to put on your top-up card, then divide that amount by 24.

If the amount you calculate is considerably less than the amount per month for a pay monthly contract for the same handset – then pay-as-you-go could be the option for you. You might also want to add in the monthly cost of a Sony Ericsson mobile phone insurance package for the phone too – you'll see why later. We said a moment ago that the calculation you end up with should be "considerably less ...".

If the amount you calculate is within just a pound or two of a pay monthly contract, you may well be better off with the monthly contract – as we all invariably end up using our mobiles, especially if its a smartphone, far more than we anticipate – especially if, as a newcomer to smartphones, it has web access. The main reason for taking out a Sony Ericsson mobile phone insurance deal for a pay-as-you-go phone is so that, in the event of it being stolen or accidentally damaged it can be immediately replaced or repaired – without you having to get into debt paying for another handset.

Pay Monthly Sony Ericsson mobile phone insurance

Pay monthly contracts are popular with both business users and those personal users who rely heavily on keeping in touch with friends and family through their mobile handsets. Sadly, an awful lot of those people think that because they're on a pay monthly contract – that their mobile phone handset is automatically covered by Sony Ericsson mobile phone insurance.

This is a false belief, unless the person or website selling the handset issues you with a separate Sony Ericsson mobile phone insurance agreement at the point of purchase. Understandably, vendors of mobile phone contracts want to keep the monthly prices they advertise to a minimum and so will not include their charges to set up a Sony Ericsson mobile phone insurance contract in with the handset/network monthly charges.

Taking out Sony Ericsson mobile phone insurance is important for pay monthly users as if they didn't take out any insurance, but were to lose, have stolen or damage severely the mobile phone handset – they wouldn't have a handset to use and yet would still have to continue paying the monthly contract. The cost of Sony Ericsson mobile phone insurance will, of course, vary according to the value of the handset and the monthly contract payments you are making, with prices starting from below £2 a month and up to around £5 a month for the "top of the range" handsets.

Don't forget here too that if you were to lose, have stolen or damaged at any time in the end of the Sony Ericsson mobile phone insurance policy contract – you will be given a new replacement handset just as if your 24 month rental/network contract were at an end anyway.

What's so special about '24' in Sony Ericsson mobile phone insurance?

When looking at pay-as-you-go Sony Ericsson mobile phone insurance calculations we said to divide the sum arrived at by 24. The reason for that is test whether or not you will actually be better off using pay-as-you-go top-up credit rather than a pay monthly contract with Sony Ericsson mobile phone insurance.

Normal practice, by the network providers and handset vendors who arrange pay monthly contracts, is for these contracts to run for at least 24 months then, at the end of that period, in order to encourage you to renew your contract with them they will offer you an 'upgrade' on your mobile or smartphone handset. This 'upgrade' simply means that they will replace your existing one with the latest model of the same relative value and usually from the same manufacturer.

Put another way, at the end of 24 months your handset is considered to be out of date and in need of changing. So, if you buy a pay-as-you-go mobile you too need to think in terms of it needing replacing in 24 months time. Subsequently, you might want to take that into consideration when considering if, in the long run, you might not be better off with a pay monthly contract and Sony Ericsson mobile phone insurance after all – rather than having to pay out for a new phone yourself every two years.